Are you shortly to join 5 million other Americans living in a condo?

They can be a great choice for many people. You get shared amenities and a homeowners association (HOA) making sure everything is ship-shape!

It can be a little confusing though figuring out exactly what type of condo insurance you need to get. Is that covered in your monthly HOA payment? Or do I need to get something extra?

Let’s take a closer look at some common condo insurance questions – and their answers!

Do I Need Condominium Insurance?

Let’s clear this common question up straight away – yes, you almost always do.

A condo is a home – usually an apartment-style home – that is owner-occupied. You have communal facilities that you own along with the other condo owners. A homeowners association is responsible for maintaining these shared amenities.

On a monthly basis, you will pay a fee to the homeowners association. They will use that fee to pay for cleaning, maintenance, upgrades, and importantly, insurance.

But that payment only covers shared areas of the condo. That includes the building structure and common areas. As a condo owner, you are responsible for insuring your unit.

The homeowners association rules will usually outline the type of insurance you need to have in place. They want to ensure that every unit is fully insured at all times.

If you are buying your home with a mortgage, your lender will also have insurance requirements. You will likely need to have this insurance in place before closing on the purchase of the condo.

So, is condo insurance required? Absolutely!

What Does the HOA Policy Cover?

Insuring a condo is very different from insuring a house.

When you insure a house, you need to buy a policy that covers the inside and outside of your home. It needs to provide protection for damage to the roof, walls, and siding, as well as the interior of the property.

However, when you live in a condo, much of this is covered by the HOA’s policy. This is also called a master policy.

They take responsibility for insuring the common areas. But that doesn’t mean that your financial liability is over.

Let’s look at an example. Imagine that the condo roof is damaged during a hurricane. The HOA makes a claim to the insurer and the repairs are carried out.

The deductible is $5,000. This may be split between the individual condo owners. So if there are 20 condos, each condo owner will have to pay $250 each.

It’s important to get familiar with your condo’s HOA rules and insurance agreements before you buy. This will help you to see exactly what you are liable for in the event of an insurance claim, and will help you to avoid any nasty surprises.

Three Types of HOA Insurance

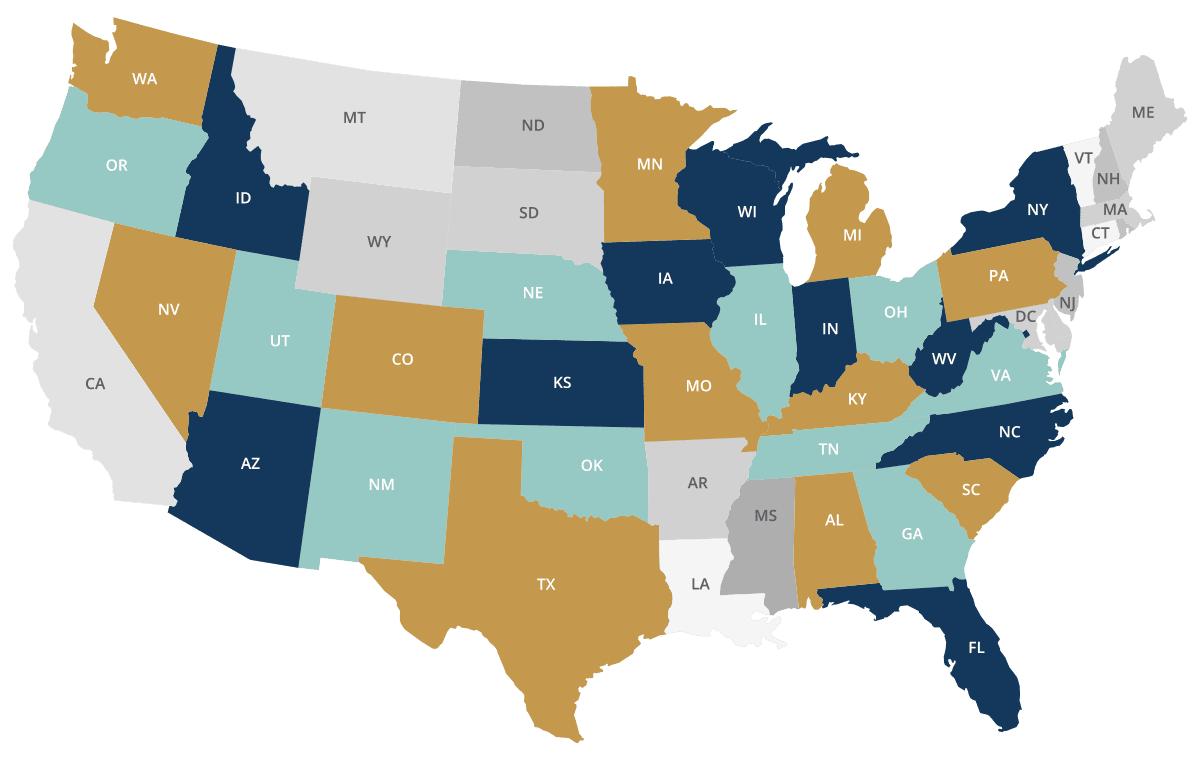

Condo insurance laws vary from state to state. Generally, HOA management can choose one of three types of insurance:

All-in

This provides a high level of protection for the condo’s shared amenities and structures, as well as the fabric of your condo. It may even cover the changes you make to your condo, such as your wall coverings and tile.

Bare Walls

This type only covers the shared areas and the fabric of the building. It does not provide coverage for anything inside your condo.

Single Entity

This type of policy sits somewhere between an all-in and a bare walls policy. It gives you some insurance for the interior of your home and includes built-in cupboards and some fixtures.

When you are planning to purchase a condo, get familiar with their HOA insurance. This will help you to ascertain the right level of cover you need for your condo.

What Does Condominium Insurance Cover?

In insurance-speak, condo insurance is also known as an HO-6 policy.

Your HO-6 policy is there to cover everything that is not covered by the HOA’s master policy. Typically, this will include any non-standard fixtures in your home and all its contents.

It will also cover you in the event of injury to you or a guest in your condo.

If your condo gets damaged in a fire, the HOA policy will normally cover the building damage. But your clothes, personal belongings, and accommodation expenses? They’d come out of your HO-6 policy.

How Do I Work Out Liability?

One of the confusing things about condo insurance is that different parties are liable in different parts of your home.

For example, if you have guests over and they injure themselves on a poorly maintained communal stairway. In that case, the HOA is liable.

But what if they slip and fall in your kitchen? That’s when you would be liable, and need HO-6 condo insurance to protect you.

A standard condo insurance policy will include personal liability coverage of up to $300,000.

How Much Coverage Do I Need?

This will vary from home to home and person to person.

Your insurance company will help you to calculate how much coverage you need. They base their calculations on the square footage of the condo and the cost of kitchen and bathroom finishes.

They will also help you to go through all your personal possessions and calculate the cost of replacing them. You may wish to purchase an additional cover that will pay out the cost of new replacements, rather than a depreciated value.

The Importance of Condo Insurance

We hope that this article has definitively answered the question, ‘Do I need condo insurance?’

Whether you want to protect your possessions, or yourself, condo insurance is essential. The master policy will usually only cover the shell of the building – everything inside is your responsibility. For your peace of mind, you need to get the right condo insurance policy.

At Gessel & Associates, we’ll help you to negotiate the tricky world of condo insurance. We’ll go through your HOA bylaws and talk to you about your needs. We’ll help you find the perfect policy for your family.

Contact us today to talk more about condo insurance.