Before investing in a homeowners insurance policy, you need to make sure it fits your needs. Ask these important questions before making a decision.

5.7% of homes that were insured had a claim in 2018.

Whether you’re required to purchase homeowners insurance by your mortgage lender, or you just want to buy insurance for the home you own outright, choosing a homeowners insurance policy can be overwhelming.

If you don’t get your policy right, you could end up not having enough coverage in the event that your property is damaged.

To avoid that outcome, check out this list of 11 crucial questions to ask about your homeowners insurance policy, and discuss them with your agent before signing your policy contract.

1. What Does a Standard Homeowners Policy Cover?

When shopping around for homeowners insurance, the first thing you’ll want to understand is what is covered under a standard policy. Typically, standard homeowners insurance policies will include several primary kinds of coverage, which are:

- Dwelling coverage (covers the physical structure of your home)

- Other Structures coverage (covers any structure not attached to your home)

- Personal Property coverage (covers your personal possessions inside the home)

- Loss of Use coverage (covers other living expenses that might come up if you’ve been displaced from your home)

- Liability coverage (covers the costs that are related to injury or damage you are legally responsible for)

- Medical Payments coverage (covers medical expenses related to injury on your property)

Homeowners insurance companies offer additional options when it comes to homeowners insurance policies, so you can add what you need on top of the average policy. It is important to discuss optional coverage available with your agent.

2. Do I Need Flood or Earthquake Insurance?

It’s important to know when you’re looking for homeowners insurance that flood insurance is only very rarely included in a standard homeowners insurance policy. It is almost always necessary to purchase a separate policy.

If you live in a region or area where you’re at a high flood risk, it’s a good idea to buy a flood insurance policy. It’s possible that your mortgage lender will actually require you to buy one.

Flood insurance isn’t the same thing as hazard insurance. Although the term hazard insurance does generally refer to the section of your policy that protects your home from fire, severe storms, or other natural disasters.

Earthquakes are also not typically covered under your hazard insurance coverage. That means that if you live in an area where you’re at high risk to experience earthquakes, you might want to buy a separate earthquake insurance policy. Other disasters that aren’t typically covered in a standard policy include nuclear explosion, sinkhole and mine subsidence, or volcanic eruption.

3. How Much Does Homeowners Insurance Cost?

How much your home insurance policy costs is going to depend on a number of different factors. The average amount that Americans pay annually for their premium is $1,200.

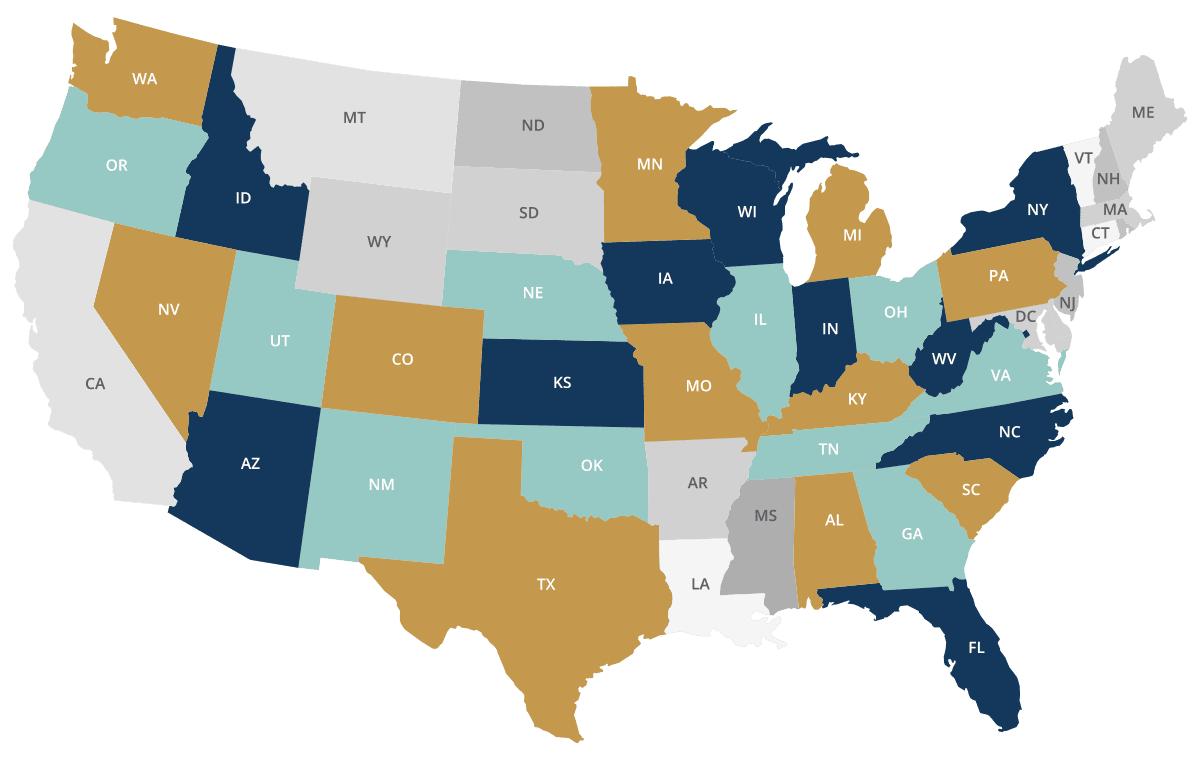

One of the factors that impacts your insurance rate will be your location. In some states, the average annual cost is much higher than in others. In Oklahoma, for example, the average is $1,885, while in Hawaii the average is only $1,135.

The cost of your home insurance will also depend on how much coverage you need.

4. How Much Insurance Do I Need?

How much insurance you need is going to depend on the type of house you are buying.

It’s important, however, that you buy the right amount of coverage. If you buy too much, you’re wasting your money. If you buy too little, then you might not have enough to cover the cost of potential damage to your home.

There are different levels of protection when it comes to insurance plans. One is actual cash value. This covers the value of your house and the belongings inside it, with depreciation for the age and condition of your house.

Replacement Cost is the next level of coverage. This means that it covers the value of your house without taking depreciation into account. This is, therefore, a more robust coverage type, since your home will be totally rebuilt like it was prior to the loss.

During the process of securing homeowners insurance, your agent will be personally and professionally responsible for advising you on how much coverage is needed for your situation.

5. How Much Liability Protection Do I Need?

If someone else gets injured on your property, it could mean that you’re on the hook for legal payments or medical bills. Personal Liability coverage will pay for your legal defense costs, and for the cost of damage or injury when you are held responsible.

Standard liability coverage is included within your homeowners policy, and it is not necessary to buy it separately. A typical limit of liability under your policy is $300,000, but you can always raise this amount for more protection.

A Personal Umbrella policy would provide additional liability coverage beyond what is available through your standard homeowners policy, and is yet another important consideration to discuss with your agent.

6. Will My Homeowners Insurance Go Up After a Claim?

This is something that will depend on the circumstance. Your premium might go up after you make a claim, but the increase might not occur immediately. Sometimes, your homeowners insurance will stay the same.

Since policies are full-year contracts, your rates stay the same for the extent of the policy. If you make a claim at the beginning of your policy’s year, then you won’t see an increase until at least your next policy year starts.

There is a lot of varied information that insurers look at when determining how much your rates should be.

It’s important to consider the fact that your rates could go up when making a claim. If a claim is small and barely exceeds your deductible, it might not be worth making a claim about it. Contacting your insurer directly to discuss a claim, or make a claim inquiry at all, can also often affect your premium whether anything is even paid out. Your agent should always be your first point of contact for a claim consultation.

7. How Can I Save on My Homeowners Insurance?

There are a number of ways you can save on your homeowners insurance policy.

One way that people do this is by minimizing risk. For example, regardless of where you live, installing a deadbolt or security system will typically lower your rates as it helps to lessen your risk of theft or break-in.

There are also often discounts available when buying insurance. One way that people commonly save money is by bundling both their auto insurance and home insurance together with the same insurance company. This also means that you only have to deal with one insurer instead of two.

Your agent will make certain you are maximizing all available discounts on your coverage.

8. What Are the Policy Limits?

Also known as the coverage limit, the policy limit refers to the total maximum amount that your insurer will shell out for a claim. For example, if your mortgaged home costs $300,000 to rebuild, your dwelling policy limit will be equal to that replacement cost. And again, replacement cost is how much it would be to rebuild your home, based on the cost of labor and materials in your area.

Other policy limits are typically determined in relation to the dwelling cost. For instance, your personal property coverage limit is frequently half of your dwelling coverage limit.

9. Will I Need a Home Inspection Before Getting Home Insurance?

Home inspections are typically done by your insurance company after your homeowners insurance purchase. This is a way for homeowners insurance companies to accurately assess the risks of your home, as well as verifying the accuracy of what has been reported on your application for coverage.

Before you have a home inspection by the insurer, you’ll want to make sure that any debris on your property that could get in the way of the inspection is removed.

If unrepaired damage or risks are found, you will typically be given a fair period of time to resolve any issues the insurer found with your home.

10. How Much of a Deductible Should I Pay?

A deductible is the amount of money that you are responsible for covering before the insurance company will pay the rest of your repair costs or claim. For example, if your deductible is $1,000, then you’ll have to pay $1,000 towards any damage before your insurer will cover the rest of your expenses (up to your coverage limit).

Your annual premiums can be lower if you set a higher deductible. This can be nice as it means you pay less money for your policy each year. However, if your home gets damaged, you’ll be responsible for shelling out more money than if you kept your deductible low and had higher premiums.

11. How Do I Pay My Premium?

Homeowners insurance premiums are often included in your mortgage payment. This is a nice way of making it so all your bills are handled in one place. In this instance, an escrow account is set up by your mortgage lender to handle your homeowners insurance premium.

Otherwise, monthly and other billing options are typically available if you are not paying your premium in full.

Homeowners Insurance Policy: Do You Have the Right Policy For Your Property?

No one ever wants to have to make a homeowners insurance claim, but sometimes the unexpected happens. As the old saying goes, it’s important to hope for the best, but always plan for the worst.

No one likes to spend an evening thinking about or dealing with their insurance. However, it’s important to assess your existing policy with a professional, and make sure that you have the coverage you need. Otherwise, you could very easily get caught without the protection you assumed you were purchasing all along.

Remember, don’t be hesitant to speak with your agent and ask them questions about your policy. While policies can read like a foreign language, it’s important that you understand the basics of your coverage, and work with an expert agent. This can make it so you sleep easier, knowing that you’re covered if something unexpected and unfortunate were to occur.

Is it time for you to review your homeowners insurance? Schedule a consultation with Gessel & Associates today!