Although owning a car is convenient, it can come with a lot of expenses. You have to buy gas, get the oil changed, buy new tires, perform other routine maintenance, buy windshield wipers and windshield washer fluid, and on and on…

If you’re looking for places to save money, you might start to wonder if you really need to pay for car insurance.

Auto insurance is incredibly important, and in most cases, it is required by law. Read on to learn more about all the benefits car insurance can provide and why it’s important to maintain it.

- It’s Required by Law

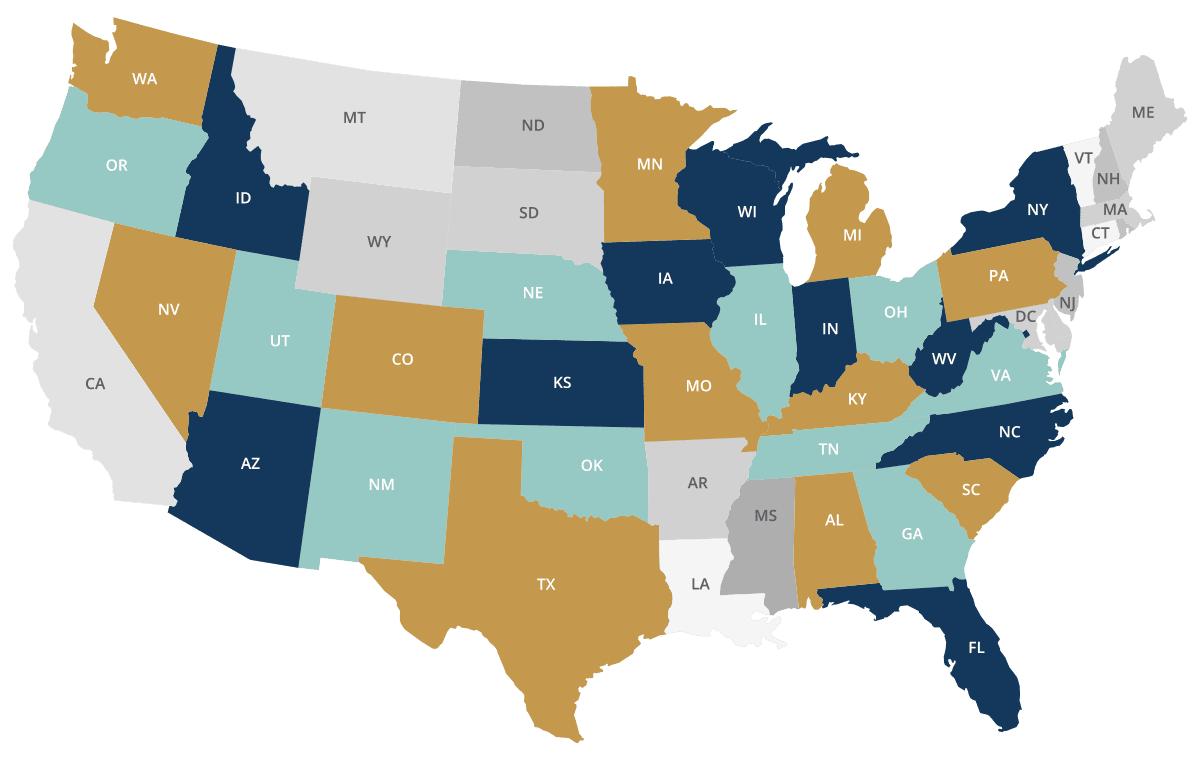

One of the biggest reasons many of us have car insurance is that it’s required by law almost everywhere. In fact, there are just two states that don’t require drivers to have car insurance: New Hampshire and Virginia. And even in Virginia, there’s a $500 annual fee for not having car insurance.

As we’ll discuss more later, if you have a car loan, your lender might also require you to maintain car insurance. In both cases, this insurance is required as a way to protect both you and the state or lender. If you’re involved in an accident, any damage that results will be covered even if you can’t afford to pay those costs out of pocket.

- Damage to Your Car

Other than legal requirements, it’s important to maintain car insurance in case your car gets damaged. Even minor car repairs can get expensive, and if you have to replace a major system in your car, it could throw you into financial havoc. In fact, most car repairs cost on average somewhere between $500 and $600.

If you get into an accident, the damage to your car could wind up being more than the actual value of the car. You could even have damage from a hit and run or vandalism that you have to pay to repair. Insurance will cover most of the costs of these repairs, even if you don’t know where the damage came from or the wreck was your fault.

- Damage to Another Car

Of course, if you get into a car accident, your car isn’t the only one you have to worry about being damaged. If you caused the wreck, you could be on the hook for the damage done to the other driver’s car. So now not only are you having to pay for your car repairs, but you’re having to cover the cost of their repairs, too.

The financial impact of this damage can go up exponentially depending on what sort of car you hit. As you might imagine, hitting a Corvette is going to cost you more than hitting a Ford 500. Insurance can cover the costs for repairs to the other car, no matter what model you’re involved in the wreck with.

- Natural Damage

Of course, car accidents aren’t the only way your car can get damaged. A strong wind storm could drop a tree branch on the roof of your car, or hail could dent the hood and crack the windshield. A flood could destroy your car entirely, or you could lose the vehicle in a wildfire or a tornado.

Car insurance also helps to cover damage and loss from these sorts of natural disasters, in addition to damage from accidents. In some cases, you may have to prove that the damage done to your car was as a result of the natural event and not, for instance, a neighborhood kid throwing a baseball. But when bad weather strikes, your car insurance company will have your back.

- Liability

One of the most potentially devastating parts of being involved in an accident is the possibility of liability. If you cause an accident that injures somebody, a judge could decide that you’re liable, or responsible, for their injuries. You may have to pay their medical bills, as well as damages for any emotional or mental harm you caused.

Liability lawsuits can get extraordinarily expensive, and if you don’t have the money to pay for them, the court could take your car, your home, your retirement, and any other assets you may have. Car insurance protects you from these personal expenses and helps to cover some of the costs in these suits.

- Passenger Injuries

In addition to injuring the other driver in the wreck, a car accident could injure passengers in your car. Just like with liability suits, as the driver of the car that caused the accident, you’re the one responsible for those injuries. Depending on what action your passenger decides to take, you could have to pay for their medical bills and damages, too.

Luckily, in the case of passenger injuries, you won’t have to pay for car repair or replacement, but medical bills add up quickly. On average, it costs about $10,000 per day for someone to stay in the hospital. Car insurance will help to pay those costs if you are held liable for injuries to your passengers.

- Driver Injuries

And, of course, the other person who could wind up injured in a car accident is you, the driver. Even minor fender benders could cause bruising, whiplash, and even a concussion. A more serious wreck could break bones, puncture lungs, or cause burns, internal bleeding, or worse, especially if you’re on a motorcycle.

In addition to the $10,000-per-day hospital bill, you could wind up needing physical, mental, or occupational therapy after your accident. It could take time for you to be able to get back to work, and you might lose income during that time. Your car insurance can help to cover those costs and keep this accident from being catastrophic for your finances.

- Non-Owner Accidents

In some cases, you may not even be in the car when the wreck that totals your ride happens. Let’s say you loan your car to a friend and they wrap it around a telephone pole on the way home in the rain. You’re still responsible for paying to repair your car, even if they were the ones driving it.

Car insurance is exactly what it says on the tin – insurance on your car, no matter who’s behind the wheel. Your insurance can help pay to repair or replace your car when it gets damaged in an accident, even if you weren’t driving it at the time. It can also help to cover your friend’s medical bills if they were hurt in the accident.

- It Supplements Health Insurance

In addition to protecting you against all sorts of liability and expenses, you might be surprised to learn that car insurance can actually act as a supplement to your health insurance. Oftentimes, there are expenses health insurance won’t cover for various reasons. For instance, if you don’t have dental insurance and you damage your teeth in an accident, your health insurance may not pay to have that damage fixed.

In certain cases, your car insurance can cover some of the costs related to medical treatment. Of course, most of the time, this treatment has to be related to a car accident or similar vehicle-related incident. Talk to your insurance agent about what medical coverage you can expect to see from your car insurance.

- It Protects Your Equity

If you have plenty of money, you may be looking at the costs we’re discussing and thinking, “I can afford that.” And after all, wouldn’t you save money by paying the $500 every five years or so to fix damage from a crash, rather than paying hundreds of dollars a year or more to insure your car? But getting those expenses covered by insurance is about more than just what you can afford.

As you work to pay off and maintain your car, you build equity in that vehicle. If you keep it in good enough shape and sell it at the right time, you could make enough money to use as a decent down payment on your next car. But if you have to spend thousands repairing your car or if you total it entirely, all that equity goes down the drain.

- It Protects Your Lender

If you get a loan to buy a new car, your lender will likely require you to maintain insurance on that car. During the time you’re paying off your loan, the car itself acts as the collateral that protects the lender’s investment. If you stop making payments, they can take the car back and sell it to recover the money they loaned you.

But if you get into a crash while you’re still paying off your car and the car is totaled, the lender no longer has that source of collateral. They can try to legally obligate you to pay what you owe them, but if you don’t have the money, they’re left holding the bill. A car insurance policy ensures that, even if you destroy the car and can’t afford to pay off the rest of the loan, their investment is safe.

- It Provides an Intermediary

One aspect of car wrecks that many people don’t think about is the negotiations that have to happen afterward. Let’s say you don’t have insurance and you get into an accident with another person who doesn’t have insurance. You believe they should pay for the damage to your car, they believe you should pay for the damage to theirs, and you both wind up screaming at each other across a courtroom.

Car insurance companies act as intermediaries in negotiations over who’s responsible for paying what after an accident. Your agent knows all the laws surrounding your liability and can argue in your favor so you wind up paying the least possible amount. They can also handle disagreements between you and the other person in professional, productive ways that find the best solution for everyone involved.

Types of Car Insurance

Now that you know a little more about why car insurance is so important, let’s talk some about the different types of insurance. There are six basic types of insurance: liability, collision, comprehensive, personal injury protection, uninsured/underinsured motorist, and medical payments.

Liability insurance pays for any damages you might be held liable for, including injuries to the other driver in an accident. Collision car insurance pays to fix or replace your car after an accident, even if the crash was your fault. Comprehensive insurance covers all of the above and damage to your car that didn’t come from an accident, such as damage from a storm.

Personal injury protection insurance covers your medical expenses, both direct and indirect, after an accident. Uninsured/underinsured motorist insurance covers your expenses after an accident with a driver who doesn’t have insurance. Medical payment insurance pays only for your direct medical costs after an accident.

Picking the Right Policy

One of the biggest factors in deciding which car insurance policy is right for you is your budget. It should come as no surprise that more coverage is more expensive, and you may have limitations on what you can afford. Even basic liability insurance is better than no insurance at all, and those policies are relatively affordable.

You may also need to take a look at what coverage your state and/or lender require. For instance, two states require you to hold medical payment insurance, and twelve require personal injury protection coverage. In most cases, collision and comprehensive insurance are only required on financed cars.

Learn More About Auto Insurance

Auto insurance is incredibly important for a number of reasons. For one, it may be required by either your state and/or your car financing lender. But insurance can also protect you from a variety of expenses, supplement your health insurance, provide an intermediary for negotiations, and more.

If you’d like to learn more about auto insurance, check out the rest of our site at Gessel and Associates. We believe in doing the right things for the right reasons, and we are your trusted source for insurance and competitive rates. Request a consultation today and discover smarter insurance that starts with experts who think a little differently.