The need for a business to file a commercial insurance claim always happens to the other guy. You’ve got your ducks in a row, so you won’t encounter any problems—until you do.

When The Hartford conducted a survey of business owner insurance claims over a five-year period, they found claims on more than one million liability and property policies. They predict that 40% of small businesses will experience a liability or property loss within the next ten years.

If you have insufficient insurance coverage, you risk suffering economic losses your business may not recover from. According to the Insurance Journal, 75% of U.S. businesses are underinsured by at least 40%. Labor and material shortages brought on by the pandemic have further widened this gap.

More than 15 million Americans reside in counties averaging one or more weather-related disasters per year since 2006. Following a weather-related disaster, 40% of businesses never reopen.

Bad weather is just one of the things that can destroy your business if you have insufficient coverage. Keep reading to learn more.

Frequent Claims Against Commercial Insurance Policies

During the five-year study noted above, a determination was made regarding claims happening with the highest level of frequency. Those are:

- 20% Burglary and Theft—third parties, dishonest employees, or company principles

- 15% Water and Freezing Damage—often due to snow and ice on the roof or low inside temperatures causing pipes to freeze

- 10% Fire—failure to test the fire detection and suppression equipment regularly

- 5% or less Consumer Injury and Damage—injuries clients sustain on the property

- 5% or less Product Liability—for claims against products the company manufactures

- 5% or less Struck by Object—items such as grocery carts, vehicles, or falling objects

- 5% or less Reputational Harm—lawsuits for libel and/or slander

- 5% or less Vehicular Accident—accidents using a business vehicle

A determination of the need for insurance can not be based solely on the frequency of claims. You must also consider the average dollar amount of each claim. For instance, even though reputational harm claims are under 5%, the average claim is $50,000.

Understanding business insurance and the specific needs of your company is what your commercial insurance agent helps with.

Risks of Having Insufficient Commercial Insurance

One risk your business might suffer is having insurance, but not enough to cover the necessary payout following a claim and/or lawsuit. Consider your company’s financial holdings and whether it can handle the following:

Financial Impact

If your business suffers damage from flooding, fire, hurricane, tornado, or any other natural disaster, can you handle the cost of repairs or replacement? Consider all possible losses, including the building, equipment, furniture, decorative items, and more.

In addition to the cost of restoring your property, you need to cover your employee’s wages, building rent or mortgage payments, and more while the business is closed.

Beyond natural disasters, things such as vandalism, cyber-attacks, fraud, and embezzlement financially impact the business. These acts may be from third parties, an employee, or a chief officer. The insurance necessary to cover an employee who embezzles funds vs an outside party stealing is different.

For any of these losses, an underinsured business may need to pay funds beyond what its insurance covers. This can put the business into bankruptcy, and may even force the owner to file personal bankruptcy.

Legal Action

If a client believes you have not fulfilled your portion of a contract, they have injuries because of a defective product, are in an accident with a commercial vehicle, or suffer personal injuries on your property, they may file a lawsuit against the business.

You may also have a disgruntled employee file action against you or an employee. This may be for sexual harassment, discrimination, failure to comply with ADA, or non-compliance with workers’ compensation regulations.

Litigation is costly and can last for years. According to a survey conducted by the Small Business Association (SBA), the cost of litigation ranges from $3,000 to $150,000.

Most companies use business assets to pay the damages. Many owners state paying damages has almost put them out of business.

Non-Compliance

This can happen if you fail to follow a local, state, or federal law. This can be anything from licensing, signage, or mandatory insurance coverage.

If your business is found to lack proper insurance coverage you may suffer fines, penalties, and revocation of any licensing.

One type of mandatory insurance is workers’ compensation. This policy lowers the risk of an employee who suffers injuries from suing the company.

Reputation Damage

As a small business, you are vulnerable to word-of-mouth complaints or cyberattacks undermining your company’s reputation. With the correct type of insurance coverage, you will have the funds necessary to assist with this type of damage.

Economic Disasters

Everyone knows about The Great Depression which ran from 1929 to 1938 and was the largest economic crisis in the United States. In addition to that, there have been 19 recessions in the U.S. The first is one due to the failure of the Reading Railroad in 1893.

A few other notable ones include the recession between 1973 and 1975, which quadrupled oil prices because of the OPEC oil embargo. Between 1980 to 1982 there were two recessions because the federal government raised interest rates to combat inflation.

Move up to the 21st century, where we have three recessions already under our belt. The first was in 2001 which began with a boom and burst in the dot-com businesses. The 9/11 attack made the recession worse.

The Great Recession took place from 2008 to 2009 and was the longest economic contraction since The Great Depression. Unemployment rose to 10% and a mortgage crisis triggered a bank credit crisis.

The 2020 recession is the worst economic disaster in the country since the Great Depression. The economy lost 20.5 million jobs, unemployment went to 14.7%, and the pandemic caused a stock market crash. Businesses are still trying to recover.

As a business, you cannot plan for economic disasters. What you can do is speak with your business insurance company about the best way to provide coverage for you and your business during recessions.

Is Your Business Underinsured?

Small businesses usually claim the cost of insurance, being unsure of what coverage they need, or believing they don’t need insurance as a reason for lacking coverage. Purchasing a minimum amount of insurance is one of the ways businesses try to save money. This may cost them the entire business if a problem arises.

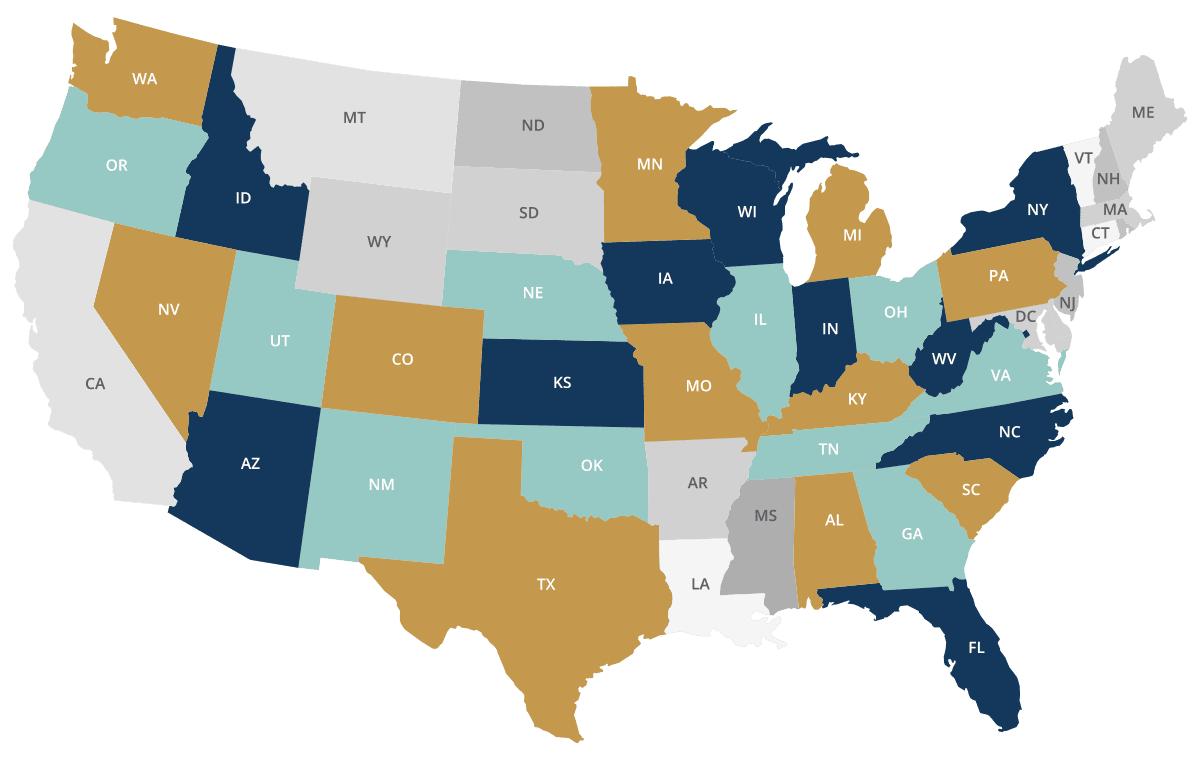

Gessel & Associates Insurance Agency specializes in commercial insurance. Check out our clickable coverage page. Click the image that represents your industry. On the next page, tap the dots you see on a business photo to learn about areas of risk your company faces.

Your next step is to contact Gessel & Associates Insurance Agency at 740-852-7725 to request a consultation today.